Budgeting for Families dives into the importance of managing finances as a family unit, offering tips and strategies to ensure a stable financial future.

Learn how to create a budget, manage expenses, save for the future, and more in this comprehensive guide.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively and ensure that they are able to meet their financial goals. By creating a budgeting plan, families can track their income and expenses, identify areas where they can save money, and plan for future expenses.

Benefits of Having a Budgeting Plan

- Allows families to prioritize their spending and focus on what is important.

- Helps in reducing unnecessary expenses and avoiding debt.

- Provides a sense of control and empowerment over finances.

- Enables families to save for emergencies and future goals, such as education or retirement.

How Budgeting Can Improve Financial Stability within a Family

- Helps in avoiding living paycheck to paycheck by planning for expenses ahead of time.

- Allows families to build an emergency fund to cover unexpected costs.

- Creates a roadmap for achieving financial goals, such as buying a house or going on a vacation.

- Encourages open communication about money within the family, leading to better financial decisions.

Setting Up a Family Budget

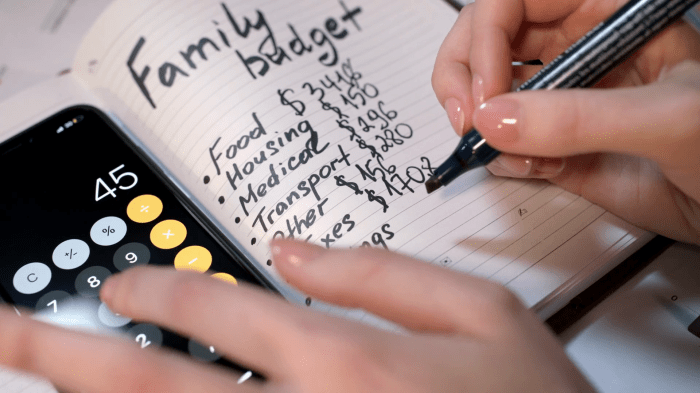

Creating a family budget is essential for financial stability and reaching your financial goals. By involving all family members in the budgeting process, you can ensure everyone is on the same page and working towards a common goal.

Steps to Create a Family Budget

- List all sources of income: Include all income streams, whether it’s from salaries, investments, or side hustles.

- Track expenses: Keep track of all expenses, from groceries to utility bills, to identify spending patterns.

- Set financial goals: Determine short-term and long-term financial goals, such as saving for a vacation or retirement.

- Create a budget: Allocate your income towards different categories like housing, transportation, and savings.

- Monitor and adjust: Regularly review your budget and make adjustments as needed to stay on track.

Tools and Resources for Budgeting

Utilize budgeting apps like Mint or YNAB to track your income and expenses efficiently.

Consider using spreadsheets or budgeting templates to create a detailed budget plan.

Seek financial advice from professionals or attend budgeting workshops to gain more insights.

Importance of Involving All Family Members

Involving all family members in the budgeting process promotes transparency and accountability. It allows everyone to understand the family’s financial situation and encourages teamwork towards achieving financial goals.

Managing Household Expenses

Managing household expenses is crucial for families to stay within their budget and achieve their financial goals. By identifying common expenses, finding ways to reduce costs, and implementing effective tracking strategies, families can better manage their finances.

Identifying Common Household Expenses

- Housing costs, including rent or mortgage payments

- Utilities such as electricity, water, and gas

- Groceries and household supplies

- Transportation expenses like gas, car maintenance, and public transportation

- Healthcare costs, including insurance premiums and medical bills

- Childcare or education expenses

- Debt payments, such as credit cards or loans

Tips to Reduce Household Expenses

- Meal planning and cooking at home to save on dining out costs

- Comparing prices and shopping for deals on groceries and household items

- Using energy-efficient appliances and practices to lower utility bills

- Downsizing to a smaller home or refinancing a mortgage for lower monthly payments

- Carpooling or using public transportation to reduce gas and maintenance costs

- Negotiating with service providers for lower rates or switching to cheaper options

Strategies for Tracking and Controlling Expenses, Budgeting for Families

- Creating a detailed budget with categories for each expense to track spending

- Using budgeting apps or spreadsheets to monitor income and expenses in real-time

- Reviewing monthly statements and bills to identify any unnecessary or excessive charges

- Setting financial goals and regularly reviewing progress to stay motivated and accountable

- Adjusting budget categories as needed to accommodate changes in expenses or income

Saving and Investing for the Future

In today’s fast-paced world, saving and investing for the future is crucial for families to secure financial stability and achieve long-term goals. By setting aside money for savings and wisely investing in opportunities, families can build a strong financial foundation for the years to come.

Importance of Saving and Investing for Families

One of the key reasons why saving and investing are essential for families is to create a financial safety net. By having savings in place, families can be prepared for unexpected expenses, emergencies, or future investments. Additionally, investing allows families to grow their wealth over time, beat inflation, and work towards achieving financial independence.

Different Saving and Investment Options for Families

There are various saving and investment options suitable for families, such as:

- Traditional savings accounts

- Certificates of deposit (CDs)

- Retirement accounts like 401(k) or IRA

- Education savings accounts like 529 plans

- Mutual funds

- Real estate investments

- Stocks and bonds

Tips on Allocating Funds for Saving and Investing in the Family Budget

When it comes to allocating funds for saving and investing in the family budget, consider the following tips:

- Set specific savings goals for short-term and long-term needs.

- Automate your savings by setting up regular transfers to your savings or investment accounts.

- Diversify your investments to reduce risk and maximize returns.

- Review and adjust your saving and investment strategy regularly based on your financial goals and market conditions.

- Seek advice from financial professionals to make informed decisions about saving and investing options.