Yo, diving straight into flood insurance policies, we’re about to break down the different types, benefits, factors affecting premiums, and making claims. Get ready for some real talk on protecting your home from floods!

Now, let’s get into the nitty-gritty details of flood insurance policies and why you need to have one in your back pocket.

Types of Flood Insurance Policies

When it comes to flood insurance, there are different types of policies available to cater to varying needs and situations. Let’s break it down for you:

Standard Flood Insurance

Standard flood insurance policies are typically offered through the National Flood Insurance Program (NFIP). These policies provide coverage for up to $250,000 for the structure of the home and up to $100,000 for personal belongings. It is important to note that these policies have limitations in terms of coverage, and may not cover additional living expenses in case of displacement.

Excess Flood Insurance

Excess flood insurance, also known as supplemental flood insurance, goes beyond the coverage limits of a standard flood insurance policy. This type of policy is ideal for properties located in high-risk flood zones or areas prone to severe flooding. Excess flood insurance can provide additional coverage for both the structure of the home and personal belongings, offering more comprehensive protection.

Location and Property Type Impact

The type of flood insurance policy needed can be influenced by the location of the property and the type of property itself. Properties located in high-risk flood zones may require both standard and excess flood insurance to ensure adequate coverage. Additionally, the type of property, such as a single-family home versus a condominium, can also impact the insurance needs and coverage options available.

Benefits of Flood Insurance Policies

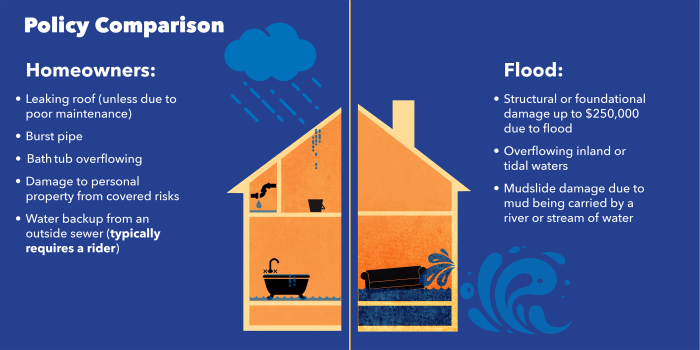

Flood insurance policies offer crucial benefits to homeowners, providing financial protection in the event of flood damage that is not typically covered by standard homeowners insurance. Let’s explore some advantages of having a flood insurance policy.

Financial Recovery After a Flood

- One of the key benefits of flood insurance is that it can help homeowners recover financially after a flood event. Without flood insurance, homeowners may face significant out-of-pocket expenses to repair or replace damaged property.

- Flood insurance can cover costs such as structural repairs, contents replacement, and temporary living expenses during the recovery period. This financial assistance can be invaluable in helping homeowners rebuild their lives after a devastating flood.

- Having flood insurance can also provide peace of mind, knowing that you have a financial safety net in place to protect your home and belongings in case of a flood.

Government-Backed vs. Private Flood Insurance

- Government-backed flood insurance policies, such as those offered through the National Flood Insurance Program (NFIP), are backed by the federal government and provide coverage for properties in participating communities. These policies have set coverage limits and premiums based on government guidelines.

- Private flood insurance policies, on the other hand, are offered by private insurance companies and may offer more flexibility in coverage options and pricing. Homeowners can often customize their coverage to suit their specific needs with private flood insurance.

- While government-backed policies may be more affordable for some homeowners, private flood insurance policies can offer additional coverage limits and options that may better meet the needs of certain properties or homeowners.

Factors Affecting Flood Insurance Premiums: Flood Insurance Policies

When it comes to determining flood insurance premiums, several key factors come into play. These factors can significantly impact the cost of coverage for homeowners in flood-prone areas.

Property Location

The location of a property is a crucial factor in determining flood insurance premiums. Homes situated in high-risk flood zones are more likely to experience flooding and, therefore, tend to have higher premiums compared to properties in low-risk areas.

Flood Zone Designation

Flood zone designation is another important factor that influences premium rates. Properties located in Special Flood Hazard Areas (SFHAs) are subject to mandatory flood insurance requirements and usually have higher premiums compared to properties in moderate to low-risk zones.

Elevation Impact

The elevation of a property plays a significant role in determining flood insurance premiums. Homes located at higher elevations are less likely to flood and may qualify for lower premium rates as they are considered to be at lower risk of flood damage.

Home Elevation Certificates, Flood insurance policies

Home elevation certificates provide detailed information about the elevation of a property in relation to the Base Flood Elevation (BFE). Properties with higher elevations than the BFE may qualify for reduced flood insurance premiums as they are deemed to be at a lower risk of flooding.

Making Claims on Flood Insurance Policies

After experiencing a flood, filing a claim on your flood insurance policy is crucial for getting the financial support you need to recover. Here’s what you need to know about the process of making a claim and ensuring a smooth experience.

Immediate Steps After a Flood

- Contact your insurance company as soon as possible to report the flood damage.

- Document the damage by taking photos or videos of the affected areas before starting any cleanup or repairs.

- Make a list of damaged items and gather any receipts or proofs of purchase.

- Do not dispose of any damaged items until an adjuster has assessed the damage.

Assessment and Claim Payouts

- Once you file a claim, an adjuster will be assigned to assess the flood damage and determine the coverage amount.

- The adjuster will inspect your property, review the documentation you provide, and estimate the cost of repairs or replacement.

- Claim payouts are typically based on the actual cash value (ACV) of the damaged property or the replacement cost value (RCV), depending on your policy.

- Factors such as deductibles, policy limits, and the cause of the flood will also affect the final claim payout.