Life insurance plans are essential financial tools that provide security and peace of mind. From different types to key factors and real-life examples, this narrative dives deep into the world of life insurance with a fresh and engaging perspective.

Whether you’re a newbie or a seasoned pro, there’s always something new to learn about life insurance plans. So buckle up and get ready for an enlightening ride through the realm of financial protection and future planning.

Types of Life Insurance Plans

Life insurance plans come in various forms to cater to different needs and preferences. The main types of life insurance plans in the market are term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It is typically more affordable than whole life insurance and offers a straightforward death benefit. However, once the term ends, the coverage also ends, and there is no cash value accumulation. This type of insurance is ideal for those looking for temporary coverage at a lower cost.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit, cash value accumulation over time, and the potential to earn dividends. Premiums are usually higher compared to term life insurance, but the policy builds cash value that can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking lifelong coverage with an investment component.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their premiums and death benefits. It offers a cash value component that earns interest based on market rates. Policyholders can use the cash value to pay premiums or increase the death benefit. Universal life insurance provides lifetime coverage with more flexibility than whole life insurance, making it suitable for individuals who want control over their policy.

Factors to Consider When Choosing a Life Insurance Plan

When selecting a life insurance plan, there are several key factors to consider. These factors can greatly influence the type of plan that would best suit your needs and provide adequate coverage for you and your loved ones.

Age

Age plays a crucial role in determining the cost of life insurance premiums. Typically, the younger you are when you purchase a policy, the lower the premium will be. This is because younger individuals are generally considered lower risk compared to older individuals. It’s important to consider your age and how it may impact the affordability of your life insurance plan.

Health

Your health also plays a significant role in determining the cost and availability of life insurance coverage. Individuals with pre-existing medical conditions may face higher premiums or even be denied coverage. It’s important to assess your health status and disclose any relevant information to insurance providers to ensure you get the right coverage.

Financial Goals

Consider your financial goals when choosing a life insurance plan. Determine what you want the policy to achieve – whether it’s providing financial security for your family, paying off debts, or leaving a legacy. Your financial goals will help you select a plan that aligns with your objectives and budget.

Dependents, Life insurance plans

The number of dependents you have can impact the amount of coverage you need. If you have children or other family members who rely on your income, you may need a higher coverage amount to ensure their financial stability in case of your untimely death. Consider your dependents’ needs when choosing a life insurance plan.

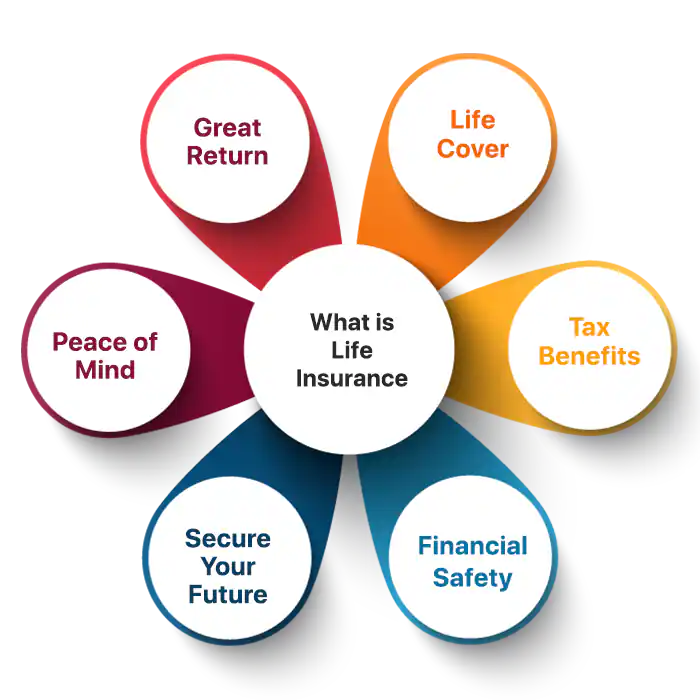

Importance of Life Insurance

Life insurance is a crucial financial tool that provides a safety net for your loved ones in case of unexpected events. It offers peace of mind knowing that your family will be financially protected even after you’re gone.

Financial Security for Families

Life insurance plays a vital role in ensuring that your family members are taken care of in the event of your untimely death. For example, if the primary breadwinner of a family passes away, life insurance benefits can help cover daily expenses, mortgage payments, education costs, and other financial obligations, preventing the family from facing financial hardships.

Investment Tool for Future Planning

Life insurance can also serve as an investment tool for future planning. Some life insurance policies, such as whole life insurance, offer a cash value component that grows over time. This cash value can be used for various purposes, such as supplementing retirement income, funding your child’s education, or covering emergency expenses. Additionally, life insurance can provide tax-deferred growth on the cash value, making it a valuable asset for long-term financial planning.

How to Calculate Life Insurance Coverage: Life Insurance Plans

When it comes to determining the right amount of life insurance coverage, there are several factors to consider. These include your income, debts, expenses, and future financial goals. Calculating the appropriate coverage amount is crucial to ensure that your loved ones are adequately protected in the event of your passing.

Step-by-Step Guide

- Calculate your annual income: Determine how much income your family would need to maintain their current lifestyle if you were no longer around. This will help you establish a baseline for your coverage amount.

- Assess your debts: Consider any outstanding debts you may have, such as a mortgage, car loans, or credit card debt. Your life insurance coverage should be sufficient to cover these expenses.

- Factor in your expenses: Calculate your monthly expenses, including utilities, groceries, childcare, and other essential costs. Multiply this amount by 12 to determine your annual expenses.

- Consider future financial goals: Think about any future financial goals you have, such as funding your children’s education or saving for retirement. Your life insurance coverage should account for these goals.

Remember, the goal of life insurance is to provide financial protection for your loved ones, so it’s important to calculate a coverage amount that adequately meets their needs.