Yo, peeps! Ready to dive into the loan approval process? Get ready to rock and roll as we break down the key stages, documentation, credit scores, income verification, and more in this financial journey. It’s time to level up your knowledge game and conquer the loan approval process like a boss!

Loan Approval Process Overview

When applying for a loan, it is essential to understand the loan approval process. This process involves several key stages that determine whether an individual or a business qualifies for a loan. Financial institutions carefully assess various factors before approving a loan to minimize the risk of default.

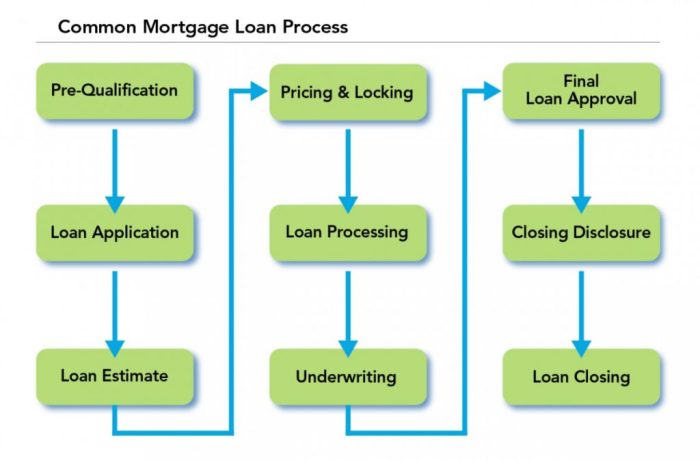

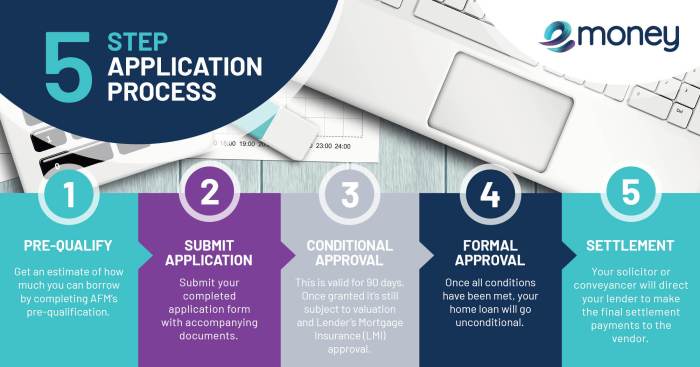

Key Stages in the Loan Approval Process

- Application Submission: The first step is to submit a loan application, providing detailed information about personal or business finances, credit history, and the purpose of the loan.

- Review and Verification: Financial institutions review the application, verify the information provided, and assess the creditworthiness of the borrower.

- Underwriting: During the underwriting stage, the lender evaluates the risk associated with the loan and determines the terms and conditions.

- Approval or Rejection: Based on the evaluation, the loan application is either approved, rejected, or approved with conditions.

- Loan Funding: If the application is approved, the loan is funded, and the borrower receives the requested funds.

Importance of the Loan Approval Process in Financial Institutions

The loan approval process is crucial for financial institutions to manage risk effectively and ensure the sustainability of their operations. By carefully evaluating loan applications, lenders can minimize the likelihood of default and make informed decisions about lending money. This process helps maintain the financial stability of the institution and protects the interests of both borrowers and lenders.

Documentation Required

To get your loan approved, you’ll need to provide specific documents to the lender for verification. These documents are crucial to demonstrate your financial stability and ability to repay the loan.

Common Documents

- Proof of income: This includes pay stubs, W-2 forms, or tax returns to show your earnings.

- Identification: A government-issued ID like a driver’s license or passport for verification purposes.

- Credit history: Lenders will request your credit report to assess your creditworthiness.

- Bank statements: To verify your assets and savings.

- Employment verification: A letter from your employer confirming your job status and income.

Importance of Documents

Providing these documents is essential for the loan approval process as they help the lender assess your financial situation. Proof of income shows that you have a stable source of funds to make regular payments. Your credit history reflects your past behavior with loans and debts, indicating your ability to manage finances responsibly. Bank statements and employment verification provide additional security for the lender, ensuring that you can meet the financial obligations of the loan.

Comparison of Documentation

| Document | Mortgage | Personal Loan |

|---|---|---|

| Proof of income | Usually requires more detailed income verification due to the larger loan amount. | Basic proof of income is needed, as personal loans are typically smaller. |

| Identification | Standard requirement for both mortgage and personal loans. | Standard requirement for both mortgage and personal loans. |

| Credit history | Extensively reviewed for mortgage loans to determine interest rates and terms. | Important for personal loans but may have less impact on approval. |

| Bank statements | More scrutiny on assets and savings for mortgage loans due to higher risk. | Basic verification of bank accounts for personal loans. |

| Employment verification | Thorough verification of employment status and stability for mortgage approval. | Basic confirmation of employment for personal loan approval. |

Credit Score Assessment

In the loan approval process, credit scores play a crucial role in determining an applicant’s creditworthiness. Lenders use credit scores to assess the risk of lending money to an individual and to make decisions on loan approvals.

Significance of Credit Scores

- Credit scores provide a snapshot of an individual’s credit history and financial behavior.

- Higher credit scores indicate a lower risk for lenders, making it easier to secure loans with favorable terms.

- Lower credit scores may result in higher interest rates or even loan denial.

Impact on Loan Approval Decisions

- Lenders use credit scores to determine the likelihood of timely repayment of the loan.

- Higher credit scores increase the chances of loan approval and access to lower interest rates.

- Lower credit scores may lead to loan rejections or higher interest rates to compensate for the perceived risk.

Tips for Improving Credit Scores

- Pay bills on time to establish a positive payment history.

- Keep credit card balances low and avoid maxing out credit limits.

- Regularly check credit reports for errors and dispute any inaccuracies.

- Avoid opening multiple new credit accounts within a short period.

Income Verification

When it comes to the loan approval process, verifying the borrower’s income is a crucial step for lenders. This helps ensure that the borrower has the financial capacity to repay the loan amount as agreed. Inaccurate income verification can lead to default on the loan, causing financial loss to the lender and potential financial distress for the borrower.

Process of Income Verification

- Lenders may request recent pay stubs or salary statements to verify the borrower’s income.

- Income tax returns for the past few years can also be requested to assess the stability of the borrower’s income.

- Self-employed individuals may need to provide profit and loss statements or business tax returns as income verification.

- Additional sources of income, such as rental income or investment dividends, may need to be documented for a comprehensive income assessment.

Importance of Accurate Income Verification

- Accurate income verification helps lenders determine the borrower’s ability to make timely loan payments.

- It reduces the risk of default and ensures responsible lending practices.

- Proper income verification protects both the lender and the borrower by setting realistic repayment terms.

Examples of Acceptable Income Verification Documents

- Recent pay stubs or salary statements

- Income tax returns for the past two or three years

- Profit and loss statements for self-employed individuals

- Bank statements showing regular deposits of income

Approval and Rejection Criteria: Loan Approval Process

When it comes to getting approved for a loan, lenders look at various factors to determine whether to approve or reject an application. Factors such as credit history, debt-to-income ratio, and employment status play a crucial role in the decision-making process.

Credit History

Lenders typically check your credit history to assess how responsible you are with managing debt. A good credit score increases your chances of approval, while a poor credit score may lead to rejection. Late payments, defaults, and high levels of debt can negatively impact your credit history.

Debt-to-Income Ratio

Your debt-to-income ratio is another important factor that lenders consider. This ratio compares your monthly debt payments to your monthly income. A high debt-to-income ratio indicates that you may struggle to make loan payments, which could result in rejection. Lenders prefer to see a lower ratio to minimize the risk of default.

Employment Status

Having a stable job with a steady income is essential for loan approval. Lenders want to ensure that you have the means to repay the loan. If you are unemployed or have irregular income, it may be challenging to get approved for a loan. A consistent employment history and regular income can improve your chances of approval.

What Borrowers Can Do

To meet approval criteria, borrowers can take steps to improve their credit score, reduce their debt-to-income ratio, and secure stable employment. Paying bills on time, reducing debt, and maintaining a steady job can enhance your financial profile and increase your chances of getting approved for a loan.

Role of Underwriters

Underwriters play a crucial role in the loan approval process by carefully assessing the risk associated with each loan application. Their primary responsibility is to evaluate the applicant’s financial situation and determine whether they meet the lender’s criteria for approval.

Risk Assessment and Recommendations

Underwriters assess risk by reviewing the applicant’s credit score, income, debts, and other financial information. Based on this evaluation, they make recommendations to approve or deny the loan application.

- Underwriters analyze the borrower’s credit history to gauge their likelihood of repaying the loan on time. A higher credit score generally indicates lower risk, while a lower score may raise concerns.

- Income verification is also a key factor in the underwriting process. Underwriters assess the borrower’s income stability and adequacy to ensure they can afford the loan payments.

- Debt-to-income ratio is another important metric considered by underwriters. A high ratio may signal financial strain and increase the risk of default.

- Underwriters may request additional documentation or clarification from the applicant to make an informed decision about the loan application.

Importance of Underwriters

Underwriters play a vital role in ensuring responsible lending practices and protecting both the lender and the borrower. By carefully evaluating each application, underwriters help mitigate risks and prevent potential defaults.

Timelines and Communication

When it comes to the loan approval process, it’s crucial to understand the typical timelines involved and the importance of clear communication between borrowers and lenders.

Typical Timelines

Once you submit your loan application, the approval process can vary in length depending on the complexity of your financial situation and the type of loan you’re applying for. Typically, you can expect to receive a decision within a few days to a few weeks.

Importance of Clear Communication

Clear communication between borrowers and lenders is key to ensuring a smooth approval process. Make sure to promptly provide any requested documentation and respond to any inquiries from the lender in a timely manner. This will help expedite the process and prevent any unnecessary delays.

Tips for Borrowers

- Organize your financial documents in advance to speed up the application process.

- Be responsive to any requests for additional information from the lender.

- Stay in touch with your loan officer and ask questions if you’re unsure about any part of the process.

- Double-check all forms and documentation for accuracy before submitting them.

- Keep an eye on your email and phone for any updates or requests from the lender.